Trade CFD Shares with Tenex Market Ltd

Choose a broker that you can trust, the one who supports you with everything

that you need to excel as a trader.

Millions of raders choose to trade CFD shares and here's why:

Higher leverage

Compared to traditional trading, CFDs offer more leverage. More potential earnings and less capital expenditure for traders are associated with lower margin requirements.

No borrowing stock or shorting rules

There are no borrowing fees while shorting CFD instruments. This is so because the underlying asset is not owned by you as a trader.

No day trading requirements

Limits on the number of day trades or the minimum capital required for day trading are not applicable to the CFD market.

Little to no fees

The structure of the CFD markets is such that brokers profit from the spread that traders pay.

What are CFD shares?

A share or stock is a document that a business issues that gives its bearer the right to own a portion of the business. A corporation may issue shares or they may be bought on the stock exchange. You can acquire a stake in the business by buying shares, and you can profit from the sale of the shares.

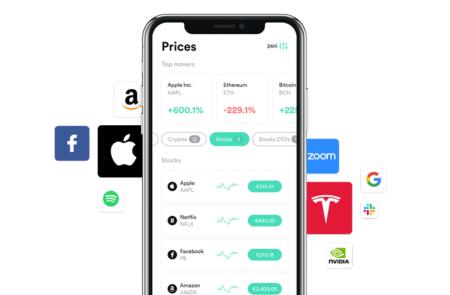

Without having to own the underlying stock, share CFDs, also known as share CFD trading, offer a special chance to speculate on changes in the share prices of publicly traded firms that are listed on exchanges like the DAX, FTSE, NYSE, and Nasdaq. Even when shares are heading in a bad direction, you can profit from the market conditions.

With CFD trading on shares, traders can take both long and short positions, which could yield profits from a rise or fall in price, respectively. Tenex Market Ltd provides online share trading for well-known companies like Facebook, Apple, and Amazon in Malaysia.